A Significant Increase In Homeowner Tenureship

Today's Homeowners Are Staying In Their Houses Longer

From 1985 to 2009, the average length of time homeowners stayed in their homes was roughly six years. But according to a study from the National Association of Realtors (NAR), that number is much higher today. In fact, since 2010, the average home tenure is just over nine years (see graph below):

What Does This Mean For Homeowners?

More Time = More Equity!

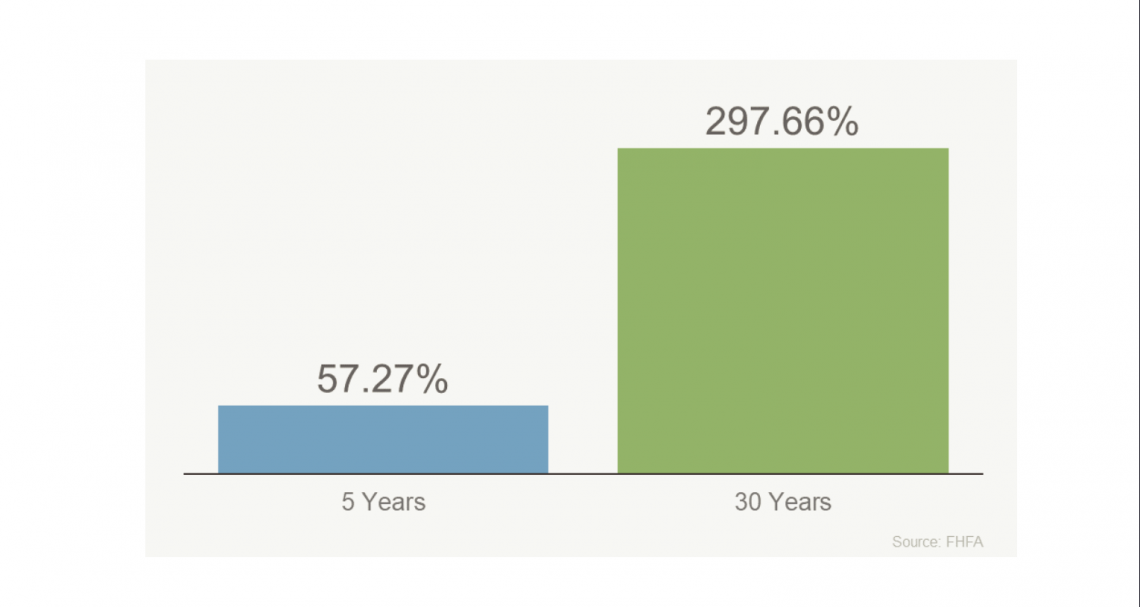

If you’ve been in your home for more than a few years, you’ve likely built up substantial equity that can fuel your next move. That’s because you gain equity as you pay down your loan and as home prices appreciate. And, the longer you’ve been in your home, the more you may have gained. Data from the Federal Housing Finance Agency (FHFA) illustrates that point:

What Does This Mean For You?

More Equity = More Spending Power

While home prices vary by area, the national average shows the typical homeowner who’s been in their house for five years saw it increase in value by nearly 60%. And the average homeowner who’s owned their home for 30 years saw it almost triple in value over that time.

Whether you’re looking to downsize, retire, or relocate, that equity can help. Wondering how to calculate your home equity spending power? We can help! Please don't hesitate to reach out via [email protected] or call 239-472-1950.

Thinking of Selling?

Let's calculate your home equity. Click the button below to send us a message.